The government has lowered interest rate on General Provident Fund (GPF)

and other similar funds in line with a general decline in overall

interest rates in the financial system. For the July-September, General

Provident Fund and other similar funds will pay 7.9% interest rate to

its subscribers, as compared to 8% in the previous quarter. This

interest rate will be applicable on provident funds of central

government employees, railways and defence forces. The rate is in line

with that of Public Provident Fund.

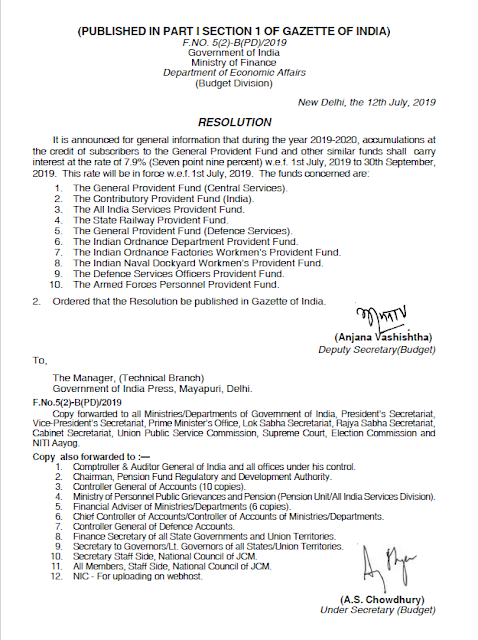

"It is announced for general

information that during the year 2019-2020, accumulations at the credit

of subscribers to the General Provident Fund and other similar funds

shall carry interest at the rate of 7.9% (Seven point nine percent)

w.e.f. 1st July, 2019 to 30th September, 2019," the Ministry of Finance

said in a notification. This rate will be in force with effect from 1st

July, 2019. The funds concerned are:

1. The General Provident Fund (Central Services).2. The Contributory Provident Fund (India).

3. The All India Services Provident Fund.

4. The State Railway Provident Fund.

5. The General Provident Fund (Defence Services).

6. The Indian Ordnance Department Provident Fund.

7. The Indian Ordnance Factories Workmen’s Provident Fund.

8. The Indian Naval Dockyard Workmen’s Provident Fund.

9. The Defence Services Officers Provident Fund.

10. The Armed Forces Personnel Provident Fund

The government had earlier hiked interest rate on GPF for October-December quarter and had kept rates unchanged since then.

Earlier, the government had cut interest rates on some small savings schemes, including PPF and Senior Citizen Savings Scheme, by 10 basis points for the July-August quarter, amid a decline in overall interest rate in the financial system. For example, PPF for the July-September quarter will fetch 7.9% interest rate (annual), as compared to 8% in the previous quarter.